IMARC Group has recently released a new research study titled “ South Korea Energy Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033 ”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Energy Market Overview

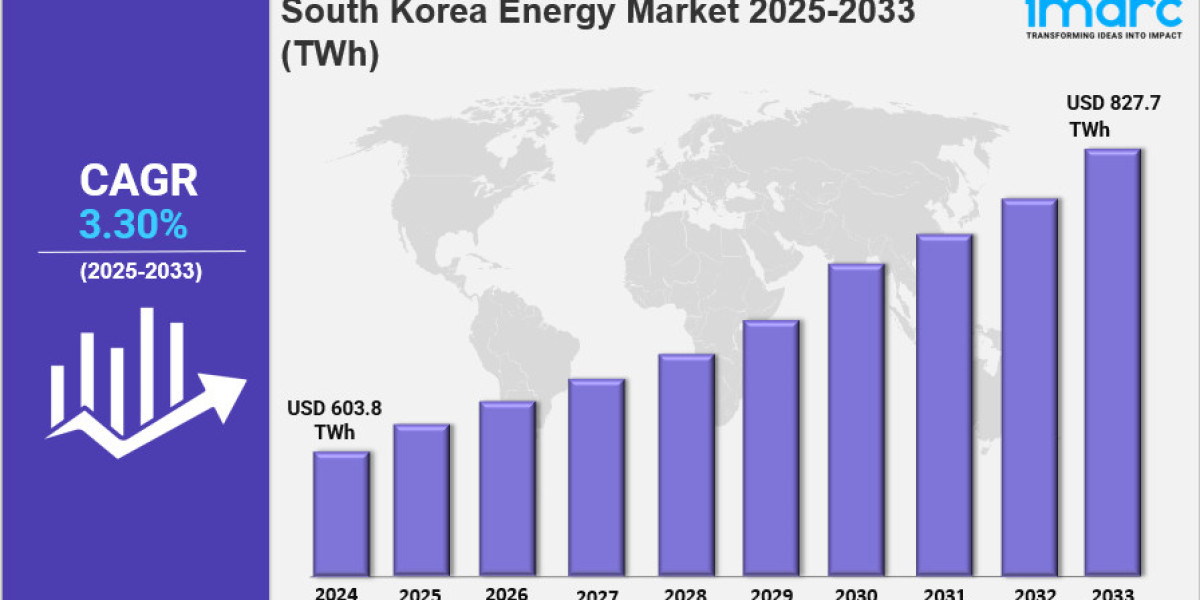

The South Korea energy market size reached 603.8 TWh in 2024 and is expected to grow to 827.7 TWh by 2033, exhibiting a CAGR of 3.30% during the forecast period 2025-2033. Significant growth is driven by a strong push towards renewables, nuclear expansion, and cleaner technologies. Policy reforms, energy security objectives, and decarbonization efforts are shaping investments and diversifying the country's overall energy mix.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

South Korea Energy Market Key Takeaways

- Current Market Size: 603.8 TWh in 2024

- CAGR: 3.30% during 2025-2033

- Forecast Period: 2025-2033

- South Korea is accelerating its transition toward renewable energy, supported by government incentives for solar, wind, and hydrogen development.

- The government aims to sustain nuclear power's share at 30% by 2030 and is investing KRW150 billion in 2025 to expand nuclear capacity.

- Major renewable projects include a $300 million investment by Vena Energy in the 384MW Yokji Offshore Wind Project.

- The country plans to increase renewable energy capacity to 7 GW annually and reduce coal generation significantly by 2038.

Sample Request Link: https://www.imarcgroup.com/south-korea-energy-market/requestsample

Market Growth Factors

South Korea's energy market is rapidly expanding due to a decisive shift towards renewable energy. Supported by government-backed incentives and policies, solar and wind power projects are booming, while hydrogen is emerging as a significant pillar of clean energy development. Infrastructure upgrades, including smart grids and energy storage systems, are facilitating the integration of intermittent renewable sources. For example, Vena Energy's $300 million investment in the 384MW Yokji Offshore Wind Project exemplifies growing foreign and domestic commitment to renewable infrastructure.

Nuclear energy remains central to South Korea's energy strategy, providing a stable and low-emission electricity source. The government declared in February 2025 an increase of KRW150 billion financial support for nuclear industry advancements. Commitment to maintaining nuclear power's 30% share by 2030 alongside new construction projects like Shin Hanul units 3 and 4 highlights nuclear's vital role in stabilizing the energy mix and achieving climate goals.

Policy reforms and energy security concerns are also driving diversification and investment. The government aims to increase renewable energy output to 7 GW each year and reduce coal-fired power generation significantly by 2038. This strategic roadmap reflects a focus on decarbonization, energy security, and technological innovation. Investments in workforce upgrades, technology exports, and safety reinforce long-term sustainability and competitiveness in South Korea's energy sector.

Market Segmentation

Type Insights

- Coal: Included as a traditional energy source; details not elaborated in the report.

- Oil: Part of the conventional energy mix; no additional details provided.

- Gas: Covered as a fossil fuel energy segment without further specifications.

- Renewables: Includes solar, wind, and hydrogen energy, supported strongly by government incentives and infrastructure upgrades to enhance integration.

- Nuclear: Comprises existing and new reactors, with government backing to expand capacity and maintain a 30% energy share by 2030.

Application Insights

- Transport: Energy use within the transportation sector; specifics not detailed.

- Electric Power: Covers electricity generation and supply encompassing all energy types.

- Agricultural: Energy consumption in agriculture; no specific data provided.

- Industrial: Industrial sector energy utilization without detailed segmentation.

- Others: Other unspecified applications within the energy market.

Regional Insights

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

Ask For an Analyst- https://www.imarcgroup.com/request?type=report&id=31554&flag=C

Regional Insights

The report identifies major regional markets such as Seoul Capital Area, Yeongnam, Honam, and Hoseo. These regions represent key geographical segments important for analyzing market distribution and regional growth.

Recent Developments & News

In March 2025, Recurrent Energy, with 3M Korea and local leaders, signed a Carbon Neutrality Agreement to develop a 200MW solar power plant in Naju City. This partnership promotes decarbonization, sustainable energy independence, and job creation. In February 2025, the South Korean government announced plans for two large nuclear reactors and a small modular reactor by 2038, targeting 70% carbon-free power generation. The plans include increasing renewable energy capacity to 7 GW annually and significantly reducing coal power generation by 2038.

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302