Accurately preparing and submitting QuickBooks Form 941 is crucial for maintaining your business's compliance with quarterly IRS payroll tax mandates. This form details employee earnings, federal income tax deductions, along with the contributions from both the employer and employees for Social Security and Medicare taxes. QuickBooks streamlines this procedure by automatically recording payroll information, calculating the necessary taxes, and creating the form using data saved in your payroll system.

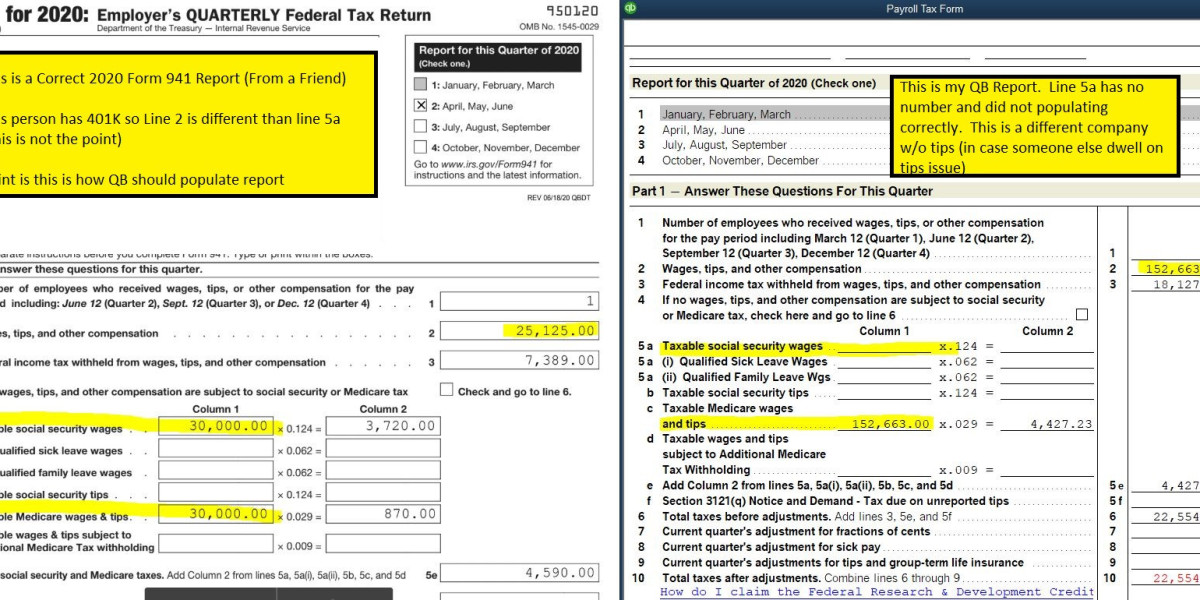

To start, examine your payroll documentation for the quarter to confirm that all employee information, earnings, and tax deductions are accurate. Generate payroll summary reports in QuickBooks to ensure precision prior to form creation. Afterwards, go to the payroll tax section and choose Form 941. QuickBooks will automatically fill in the majority of fields, but it's critical to carefully check for any necessary adjustments, credits, and total amounts to ensure their correctness. Meticulously inspect the form line by line before you submit it.

Once you have verified everything, you can file QuickBooks Form 941 electronically via QuickBooks, or alternatively, print and send it to the IRS by mail. Maintaining digital records and scheduling quarterly reminders will help ensure that future submissions are punctual and consistent. Proper preparation minimizes the risk of penalties, decreases errors, and keeps your payroll operations functioning efficiently.

If you need help filing your e-tax form 941, call our senior QuickBooks professional at +1 (866) 500-0076.